These last few months, much of the country has watched in horror as the Illuminati NWO and its Secret Society’s have waged jihad on the American people from the Bundy Ranch to NATO ready to start WW3 with a current build-up of Russian troops near Ukrainian border to start an American Spring. And on the hoe front their intransigent demands for deep spending cuts, coupled with their almost gleeful willingness to destroy one of America’s most invaluable assets, its full faith and credit, were incredibly irresponsible. But they don’t care. Their goal, they believe, is worth blowing up the country to rebuild it in a new image of an fascist One World Government under a New World Order controlled by the United Nations, if that’s what it takes.

ATTENTION ATTENTION ATTENTION

There are a lot of rumors going around. Please DO NOT share anything as facts unless you see it on here, or on the blog.www.bundyranch.blogspot.com. If you would like updates through texting, you can text BUNDY to 58885, and you will automatically be added to the list. We will update you with facts 2-3 times a day.

We appreciate all of the support coming in! -God Bless America!!

Many of you have been asking for a better way to keep informed and know what you can do to help.

We love Facebook but it is not effective for getting the word out when we really need help. There are so many messages here things are getting lost.

If you go to http://bit.do/bundy you can sign up to get Emails and Text messages.

You will get messages directly from the Bundy’s.

You will not receive a bunch of junk, only important messages when we need immediate help and we will only text message you when critical action is required.

Please let others know about this ASAP.

http://bit.do/bundy

bit.do

Bad Moon Rising in Nevada at the Bundy Ranch It’s not over till the fat lady sings!r

Ralley picket

This is the Official Bundy Ranch Page.

brklynmd3 14 hours ago Ok… 2:17 am on Monday April 14 2014 and I am in touch with people on the ground… I can say, it is NOT over. Stand by.

Published on Apr 13, 2014

There are more agents and equipment arriving at the Bundy Ranch It’s NOT over. Let everyone know and get the word out.

Like ideologues everywhere, they scorn compromise. Like when John Boehner, the House speaker, tried to cut a deal with President Obama that included some modest revenue increases, they humiliated him. After an agreement was finally struck. t — amounting to a near-complete capitulation by Obama — Illuminati NWO and its Secret Society’s members went on Fox News to complain that it only called for $2.4 trillion in cuts, instead of $4 trillion. It was head-spinning.

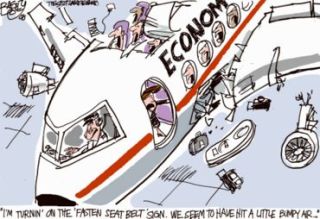

All the blogosphere and the talk shows mused about which party would come out ahead politically. Honestly, who cares? What ought to matter is not how these spending cuts will affect our politicians, but how they’ll affect the country. And I’m not even talking about the terrible toll $2.4 trillion in cuts will take on the poor and the middle class. I am talking about their effect on America’s still-ailing economy.

America’s real crisis is not a debt crisis. It’s an unemployment crisis. Yet this agreement not only doesn’t address unemployment, it’s guaranteed to make it worse. (Incredibly, the Democrats even abandoned their demand for extended unemployment benefits as part of the deal.) As Mohamed El-Erian, the chief executive of the bond investment firm Pimco, said, fiscal policy includes both a numerator and a denominator. “The numerator is debt,” he said. “But the denominator is growth.” He added, “What we have done is accelerate forward, in a self-inflicted manner, the numerator. And, in the process, we have undermined the denominator.” Economic growth could have gone a long way toward shrinking the deficit, while helping put people to work. The spending cuts will shrink growth and raise the likelihood of pushing the country back into recession.

Inflicting more pain on their countrymen doesn’t much bother the Illuminati NWO and its Secret Society’s, as they’ve repeatedly proved. What is astonishing is that both the president and House speaker are claiming that the deal will help the economy. Do they really expect us to buy that? We’ve all heard what happened in 1937 when Franklin Roosevelt, believing the Depression was over, tried to rein in federal spending. Cutting spending spiraled the country right back into the Great Depression, where it stayed until the arrival of the stimulus package known as World War II. That’s the path we’re now on. Our enemies could not have designed a better plan to weaken the American economy than this debt-ceiling deal.

One thing Roosevelt did right during the Depression was legislate into being a social safety net to soften the blows that a free-market economy can mete out in tough times. During this recession, it’s as if the government is going out of its way to make sure the blows are even more severe than they have to be. The debt-ceiling debate reflects a harsher, less empathetic America. It’s sad to see.

JOE NOCERA says that Obama should have played the 14th Amendment card, using its language about “the validity of the public debt” to unilaterally raise the debt ceiling. Yes, he would have infuriated the Republicans, but so what? They already view him as the Antichrist. Legal scholars believe that Congress would not have been able to sue to overturn his decision. Inexplicably, he chose instead a course of action that maximized the leverage of the Republican extremists.

But the debilitating deficit battles are by no means over. As has been explained ad nauseam, the threat of defense cuts is supposed to give the Republicans an incentive to play fair with the Democrats in the negotiations. But with United States being deployed in more than 150 countries around the world, which side is going to blink if the proposed cuts threaten to damage national security? Just as they did with the much-loathed bank bailout, which most Republicans spurned even though financial calamity loomed, will the Democrats and Republicans do the responsible thing. Apparently, that’s their problem they dont know how to when they are run and funded by the Illuminati NWO and its Secret Society’.

For now, the Illuminati NWO and its Secret Society’ can put aside their suicide vests. But rest assured: They’ll have them on again soon enough. After all, they’ve gotten so much encouragement.

Daniel J Leach

Daniel J Leach